Raising Financially-Educated Children

May 10, 2023Post Sponsored by InflationEducation.net

As parents of little ones, if our job is to prepare them for the world that awaits, shouldn’t that include the money system? Not just the basics of finance – saving, spending, investing, and debt – but the essence of money: What is money, what works well in the role, and how is money created?

Gap in Public, Private, and Homeschool Curriculums

Most parents (and popular curriculums) cannot touch the subject because they don’t understand it themselves. We were raised to believe today’s money is just what it should be, and the only way it could be. The truth is, we’re living in a historical aberration, using unbacked, debt-based fiat money.

Fiat means “by decree.” Thus, “fiat money” like the US Dollar bill, means “money because the government says so,” not money backed by anything real or chosen for the role by the free market.

For 5,000 years of history, what’s worked best as money is gold or silver. Paper notes or digital representations can work too, if exchangeable at fixed rates. This is called a “gold standard.”

Article 1, Section 10 of the US Constitution calls for that: “No State shall… make anything but gold or silver coin a legal tender.”

America’s founders understood the importance of money backed by gold or silver. But today’s money isn’t backed by anything. It can be created from nothing by banks and bureaucrats.

This is a problem.

Sound money, along with liberty, personal responsibility, limited government, and the concept of natural law, unleashed an economic engine that raised the living standards of America, creating the most prosperous nation the world had ever known. Americans lived like kings, white picket fence around a tire swing hanging in the yard, two cars, three kids, and central air-conditioning.

Where the Unraveling Began

For nearly 200 years since the Declaration of Independence on July 4th, 1776, America had been on one form of a gold standard or another. The last iteration was shaped by the 1944 Bretton Woods agreement when the US Dollar became the world’s reserve currency. Countries pegged their currency to the dollar, while the US agreed to exchange dollars for gold at $35 per ounce.

As America’s spending in the 1960s – or specifically, its creation of new paper and digital dollars to fund the Vietnam War and vast new social programs like Medicare – began to eclipse US gold reserves, foreigners lined up to exchange dollars for gold at the promised rate. Fort Knox was halved, and the Nixon administration panicked, ‘temporarily’ removing gold-backing from the US Dollar.

By moving to an unbacked, debt-based fiat money on August 15th, 1971, thus began the great financialization, a hollowing of America and the world with debt.

Fifty years later, as debt growth (public and private) has exceeded economic growth (or our ability to repay) for decades, the inflation at the grocery store along with recent bank runs are signals that the money system itself is breaking down, unraveling in plain sight, as ‘fiat’ money always does.

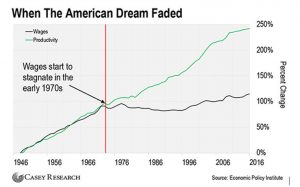

You can track a decoupling of productivity gains from wage growth right back to that date-

Because fiat money does not require gold backing, it can be created at will by governments and banking cartels, siphoning productivity gains from working people to the rentier class.

This freshly printed money is used to grow the bureaucracy, funding endless wars, massive entitlements, and ever-increasing boondoggles. We pay for this through inflation, theft of purchasing power from the dollars held in our bank accounts, and increasing prices from all the new money not earned through work or trade but created from nothing to chase the same level of goods and services.

Worse, entrepreneurs receive distorted signals about supply and demand, creating ‘malinvestment’, a boom-bust cycle of financial bubbles blowing, bursting, then being bailed out (selectively).

American families are poked, prodded, nudged, and cajoled into borrowing because a debt-based system requires endless growth. Every dollar in existence is issued as a loan and therefore requires repayment of principal plus interest – more dollars tomorrow than today – more GDP, more energy, oil, coal, corn, copper, cattle, and cobalt. If it’s not growing, the financial system is collapsing.

We call it ‘the big green blob’ (kids love the characterization).

Today’s system of money requires endless growth on a finite planet. It’s quite literally doomed to fail, the root of the world’s biggest, most intractable problems.

As it unwinds, a huge concern is all the US Dollars held overseas. As confidence wanes in our ability to maintain their purchasing power, a tsunami of dollars risks flooding back to American shores.

Unveiling the Wizard Behind the Curtain

The good news is, it’s not difficult to understand how it works or see where it’s going. And if you know where it’s going, you can better provide for your family, avoiding the major pitfalls.

They can’t teach it in school because that would reveal the con. Kids are pushed out at 18 like wind-up toys to get chewed by a debt machine, offered only two choices by a political system that both feast on the power to create money from nothing and reward insiders. It’s cronyism, not capitalism.

But you can do it, and we can help.

At InflationEducation.net, we use ‘better bedtime stories’ to help prepare children, revealing the secrets of debt-based money using the principles of America’s founding – liberty, sound money, Austrian Economics, and Natural Law. These delightful, full-color hardcovers bring it all to light, creating indelible memories for your kids as you mix them in with the classics during that nightly ritual.

Our customers like to be prepared, thus lean heavily homeschooled. We back it with an unconditional Alliance Guarantee. Buy the bundle, save 40% now and forever, and if you don’t like them, we’ll refund 100% of your money, and you can keep one anyway. It’s that important these stories find your family.

Five titles include “Where Does Money Come From?”, “Good-Debt, Bad-Debt and the Big Green Blob”, “The Big Bad Business Cycle”, “The Madness of Crowds”, and “The Beautiful Bitcoin Book”.

The stories are wonderful, but the most valuable thing we offer is free. Join our email list to receive the Ultimate Parent’s Guide to Money, Saving, & Investing, taking 25 years of research, shrinking it down to plain English, and using humor to make it fun, including a Silver Saving System for kids, plus a foolproof 10-Step Plan to start them down the path of investing. They have an advantage now they will never have like this again – the gift of time – to compound a lifetime of security and abundance.

They grow up fast. One second, you’re cutting grapes in half, and the next, they’re fending for themselves in a mixed-up world, an unanchored mess of finance and debt. Don’t miss the opportunity to open their mind, revealing the True North that our modern money system lost long ago.

Additional Homeschool Resources

PODCAST – Understanding Money with Phil Denniston & InflationEducation.net

PODCAST – Homeschoolers and Money

High School Electives: Economics

Latest Posts

While nearly every college and university today is eager to accept homeschooled students into their institutions, homeschooling families need to understand that their student’s application…

Read more >

Guest Post by Gabriel Morse For several years, I sat for long hours every day behind one of those battleship gray desks in a windowless, dull, gray office. The pay was enough to take care…

Read more >

This post is sponsored by Little Monsters Universe. I'm Tina Salmanowitz, an advocate for homeschooling and science education. With over a decade of experience as a science educator (in class…

Read more >